Asset Liability Immunization Strategy (ALIS) Insights 4th Quarter 2021 Outlook

State of the Markets

The COVID Delta variant had a significant impact on third quarter economic activity. GDP is expected to have increased 2% - 3% in the quarter, which is well below the 6.7% we saw in the second quarter. Daily cases in the U.S. increased from 25,000 to 160,000. Airline travel decreased, borders closed, and it seemed as though we headed back into renewed pandemic restrictions. August nonfarm payrolls were expected to increase 700,000 while the actual number measured slightly more than 200,000. Inflation continued to show it wasn’t transitory, as the Fed’s favorite measure showed a 4.3% annual rate versus their target of 2.0%. The CPI increased at a 5.3% annual rate versus 1.3% a year ago. Interest rates were largely unchanged for the quarter with short rates unchanged; the 5-year Treasury note increased 12 bps; the 10-year maturity increased 7 bps, and the long bond yield was essentially unchanged. There was a sharp increase in longer-term yields late in the quarter as the 10-year Treasury note yield rose 24 bps from September 22 to the end of the month.

As we look to the fourth quarter, we see some very positive developments. The Covid daily infection rates are falling sharply, setting a trend that is expected to continue. The number of people having natural or vaccinated immunity is approaching herd immunity; the CDC estimates it to be close to 83% currently. According to the JOLTS survey, there are 11 million unfilled jobs so anyone who wants to work should have the ability to find a job. A rebound in GDP is forecast for the fourth quarter to 5.1%. The market is aware the Fed wants to start to taper this year although interest rates have increased only 25 basis points. Washington is trying to pass a bipartisan infrastructure bill that would also boost economic growth, but disagreements among Democrats is delaying its passage. All of these factors will translate into fourth quarter GDP growth which will be higher than third quarter growth.

Pension Plan Index Update

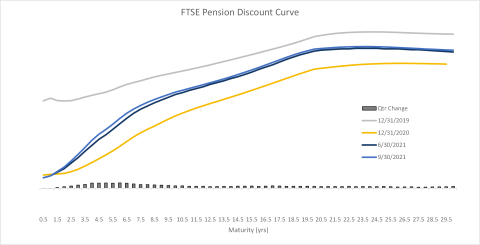

Pension discounts rates increased incrementally over the quarter with slightly larger increases in the short end of the maturity spectrum. The majority of the curve is now approximately midway between levels seen in recent year ends, 12/31/2019 and 12/31/2020. For an underfunded plan, a rising interest rate environment will increase the plan’s funded status. If we examine the year to date progress of the average plan, as measured by Milliman’s 100 Pension Funding Index, an increase in funding of 7.0% has been achieved mainly because of an improving rate environment and achievement of significant risk asset returns. A similar result in the public plan space has been reached with the average municipal plan now achieving funding levels of around 80% (Pew Charitable Trust). These are levels not seen since before the market crashed in 2008. Rising interest rates, positive equity returns, and the issuance of pension obligation bonds (POB) have assisted with State and local pension funding. At first glance, the perception that municipalities are on the path to a more stable financial footing as a result of improving pensions, may not be correct. If the funded status is a direct result of POB issuance, the reality is they have swapped a long-term fixed obligation for shorter-term equity volatity– a gambling transaction which leaves the taxpayer on the hook for any potential future shortfalls. Over the first three quarters of 2021, according to Bloomberg data, 74 municipalities ($10.3 billion) has been issued in POB debt. This rivals a degree of issuance not seen since 2003. Time will tell if the risk accepted by issuing debt to invest in the stock market will indeed produce a level of return higher than the required debt service and enable municipalities the ability to maintain their recently improved funded status. We believe it’s a trade that is beyond the scope of risk that taxpayers should be willing to accept.

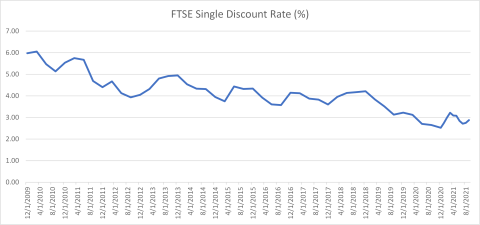

Another method of understanding pension funding level changes is to examine rate movements by incorporating the entire curve into a single discount rate and graph it over time. From the attached graph, we can see that the single rate has dropped over the past 12 years at a consistent rate; more recently the trend seems to have found a bottom. Our near-term expectations for rates in general would substantiate a reversal in recent years single rate trends.

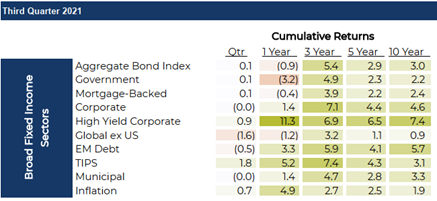

Fixed-income returns over the quarter for most of the domestic investment grade sectors were muted as concerns regarding future economic growth and heightened expectations for inflation caused rates to rise. High-yield securities produced a slight gain while inflation protected securities provided a gain of 1.8%. On a yearly basis, riskier areas of the bond market produced positive returns in comparison to the less risky areas where returns were negative. Over longer timeframes, risk acceptance produced the appropriate incremental returns for investors.

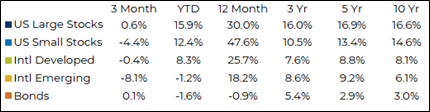

Equity returns over the quarter were less than adequate as the concerns about inflation in concert with supply chain disruptions led to a market correction in September. Sectors that were impacted the most negatively included energy, consumer staples, industrials, and materials. International stocks performed more poorly than domestic as the supply chain disruptions had an even greater impact on less developed countries. China, Brazil, and Korea declined significantly while more developed foreign countries performed in-line with the U.S. although a strengthening of the dollar led to higher declines for U.S. investors.

Economic Outlook

The evolving political landscape is less constructive than ever before. The debt ceiling issue recently arose again. Congress subsequently voted to extend the ceiling out to December, so we can worry about defaulting again in January. As the country becomes more divided and extreme, the game of politics continues to get riskier for our economy’s well-being. This time around, we anticipate Republicans may use their goodwill to trim the size of the spending/investment plans down. Our current expectation is that the social infrastructure bill will end up around $2 trillion and the bipartisan (traditional) infrastructure bill will remain at its current $550 billion, according to whitehouse.gov. Last quarter we said that shock and awe spending would influence inflationary pressures and impact near-term growth expectations. The passage of $2.5 trillion in new spending probably has a similar effect to the previously hoped for $4.5 trillion. Getting progressive and moderate Democrats to an acceptable place of compromise may be difficult but, in the end, midterms are coming, and politicians need to show they have made progress so something significant will be passed using the budget reconciliation in the next few months.

"Over the past quarter, it seemed that the inflation picture was evolving further."

Over the past quarter, it seemed that the inflation picture was evolving further. Housing is turning out to be the pain point we identified and expected (due to low financing costs and significant population migration trends, along with volatile materials costs). Through the end of July, the S&P CoreLogic Case-Shiller index of property values nationwide increased 19.7% on a year-over-year basis, the largest spike in more than 30 years. The Phoenix, Arizona, market was particularly hot, experiencing a surge of 32.4%. As we detailed last quarter, rents are increasing at nearly double-digit rates as well. The likelihood that a hybrid workplace model is a long-term trend in some industries suggests that the upper half of the housing market will see continued interest, especially in areas and pockets of the market that have been desirable. A concern for the lower half of the market is that zoning law changes could risk making starter homes unattainable for younger people. To explain further, if cities eliminate single-family housing, investors may bid up starter homes, knock them down and build multi-family housing. Sure, you have increased housing density, but you have created incentives for prices to climb, you have made potential owners into renters, the opportunity to gain sweat equity has vanished, and one of the largest wealth accumulation vehicles will be out of reach for many young people.

Wages are the area that we feel is most uncertain. In September, enhanced unemployment benefits concluded. Although the Biden administration suggested that states could choose to use their stimulus dollars to continue the benefits, to this point, we don’t see evidence that any states are choosing to do so. Perhaps the fact that the number of unfilled job vacancies in the U.S. exceeds 9.2 million (as of mid-August, per fred.stlouisfed.org) as compared to the number of unemployed persons in the U.S. at just under 8.4 million people (as of the end of August, per bls.gov) suggests that the enhanced unemployment benefits have outlived their usefulness on a broad basis. Absent government intervention, it seems that there will be a large number of workers seeking employment. The development to watch will be as people decide they need to find a job (against the backdrop of rising prices), will they demand wages that are an improvement on an inflation-adjusted basis, or will they be price takers as to the value of their time? In the first quarter of the year, we saw real wage growth measure approximately negative 2.5%. It has settled in the second quarter to something closer to negative 1%. Rising prices of commodities, especially energy/oil costs, are applying pressure to employers and employees alike. Employers have hobbled along in a scarce and skewed labor environment for more than 18 months and are now facing multiple cost pressures. It seems that in the current wage environment, the labor impasse favors the employers.

As the political realities avail themselves, the spending/investment plans seem like they will primarily pressure commodity prices, but some of the broadly defined social infrastructure could have spill-over effects that may replicate the current situation. Sticky areas of inflation, such as housing costs, as well as backlogged areas of expenses, such as shipping and transportation costs, should place a floor on how low inflation may go. Some areas of dramatic inflation may have reached levels that suggest a degree of price reversion is in order for meaningful pockets of inflation. On a year-over-year basis, here are some eye-popping numbers: Natural gas up 110%, West Texas Intermediate Crude Oil is 91% higher, coffee (a fuel of another type) increased by 80%, aluminum spiked 64%, sugar rose by 40%, copper is 39% higher, corn up by 37% and lumber prices have increased 12%. Viewed another way, imagine if those rates of price increases persisted? Legions of people would lose ground from a purchasing power and quality of life angle if wages didn’t grow dramatically. If input costs, operating costs, and labor costs all rose meaningfully, where would that place businesses and institutions if price increases could not be passed on to customers, as has been the case during many of the whiffs of inflation we have experienced over the past decade? The possibility of a volatile path of inflation creates a lot of potential paths and the prospects for above-trend inflation to make the average person’s life better is doubtful. Our expectation is that the sticky and backlogged areas of inflationary pressure will clash with other pockets of price pressures that will mean-revert toward lower prices, and although nobody really knows where it will settle, growth on the order of 1.5% to 4% seems to be a fair estimate. The low end of that estimate is based on no additional stimulus and the high end would result if all the spending passes (the $2.5 trillion mentioned earlier), plus some extension of unemployment benefit enhancements.

"...it may be the case that the Fed will try to let the economy run hot in the hope that unemployment trends lower."

Taking a slightly longer view of inflation, the Fed’s “Dot Plot” estimate of when they will need to raise short-term yields is at a 50/50 split between rising rates in 2022 versus a need to hike in 2023. It is noteworthy that this is a large change from recent guidance that suggested 2024 as the timing of the next rate hike. We believe that recent comments about the Fed’s role in addressing wealth and income inequality issues, along with past comments that may indicate that the Fed increasingly views itself as a contributor to a collection of global central banks, suggest a bias toward accommodation. Over the past seven years, the Fed noticed that as the unemployment rate fell at the same time inflation was modest, lower-skilled laborers experienced real wage growth. To replicate that environment, it may be the case that the Fed will try to let the economy run hot in the hope that unemployment trends lower. Perhaps the real magic came from low inflation and a focus on employment opportunities for moderately skilled labor.

Our call for an updraft of interest rates doesn’t have to do with run-away inflation, but rather, for some more mundane and mechanical market issues. As the Fed begins to reduce asset purchases, bond desks may choose to reduce risk exposures, which may force yields higher than would be the market effect if the impact of the reduction of the Fed’s purchases were considered in isolation. Around the time of the start of the taper, bond trading desks may need to reprice risk tolerance as the ability to sluff off risk to a captive buyer (the Fed) subsides. Bid/ask spreads may widen, meaning market liquidity may diminish and the cost to sell a bond may rise. Some corners of the bond market may experience greater impact as compared to the broader bond market. The more technical influence that could work to drive bond yields higher has to do with negative convexity hedging on the part of mortgage-backed security servicers and some holders. Convexity hedging involves selling Treasuries to compensate for the impact that rising rates have on the duration of mortgage-backed securities (as people prepay mortgages at a slower pace in a rising rate environment, it extends the interest rate risk of a mortgage-backed security). Morgan Stanley analysts estimate at current yield levels, each basis point of increase in the 10-year Treasury yield, translates into approximately $4.7 billion of selling pressure as a result of convexity hedging. Mechanically, it is a feedback loop that could result in a short-lived updraft in yields in three to six months. As rates rise, they must hedge; the selling pressure causes rates to rise further, resulting in more hedging.

"It is possible that the pandemic afforded us a window into our future, with a population of producers and a contingent of kept consumers."

Our outlook is for annoying and painful pockets of inflation, but broadly acceptable levels of inflation, spikes in yields due to mechanical issues that collectively settle lower based on the weight those influences have on the bulk of the population as they suffer through negative real wage growth. Longer-term, there will be a troubling push-pull battle between the disinflationary influences of technology, the cost of moving forward with green energy initiatives (new technologies are expensive), and the largest challenge of them all, the diminished value of human capital. The pandemic has expedited the trend toward making humans devalued, at least from a commercial and aspirational aspect. It is difficult to imagine a productivity boom and future excellence emerge from the current environment. The future looks like it will involve pockets of well-paid vocations, such as the trades, technology jobs and professional services, against a backdrop of a lot of jobs that people just will not be willing to pay much to fill because automation and other substitutes for a particular service are readily available. It is possible that the pandemic afforded us a window into our future, with a population of producers and a contingent of kept consumers.

There is a real risk that a stagflationary environment could result from the sticky sources of inflation met with negative real wage growth. Compassionate people can help their fellow citizen in ways that do more harm than good, although a well-communicated bridge to normalcy may be the healthy path back to a sustainable economic and labor environment. We expect that trillions will be spent on near term infrastructure and social programs which will perpetuate the current state of consumption, resource utilization, and modest real wage improvement. Inflation may not be as transitory as the Fed originally thought, but the weight of price increases should guide inflation to a more reasonable level over the next year or two.

The opportunities that are ahead seem as if they will be the result of mechanical issues that may occur around the time the Fed begins to taper their asset purchases. Treasuries have seen a significant move since we started writing this piece, but we expect that 10-year Treasury yields will exceed 1.70% at a point in 2021 and in 2022 we could see yields exceed 2.0% that may be coupled with spread widening in corporate bonds. Tax rates for some people and businesses will likely trend higher, and the “Trump tax cuts” may roll off between 2025 and 2027, so methods to avoid taxes will be sought in future years.

We are passionate about fostering creative ideas and exploring new opportunities for the benefit of pension plan clients. Please contact your ALIS representative at Advanced Capital Group to learn more on how we can assist with your defined benefit investment management needs.

Disclosures:

This Newsletter is impersonal and does not provide individual advice or recommendations for any specific subscriber, reader or portfolio. This Newsletter is not and should not be construed by any user and/or prospective user as, 1) a solicitation or 2) provision of investment related advice or services tailored to any particular individual’s or entity’s financial situation or investment objective(s). Investment involves substantial risk. Neither the Author, nor Advanced Capital Group, Inc. makes any guarantee or other promise as to any results that may be obtained from using the Newsletter. No reader should make any investment decision without first consulting his or her own personal financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, the Author and Advanced Capital Group, Inc., disclaim any and all liability in the event any information, commentary, analysis, opinions, advice and/or recommendations in the Newsletter prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. The Newsletter’s commentary, analysis, options, advice and recommendations present the personal and subjective views of the Author and are subject to change at any time without notice. The information provided in this Newsletter is obtained from sources which the Author and Advanced Capital Group, Inc. believe to be reliable. However, neither the Author nor Advanced Capital Group, Inc. has independently verified or otherwise investigated all such information. Neither the Author nor Advanced Capital Group, Inc. guarantee the accuracy or completeness of any such information.