ALIS Versus traditional pension plan management

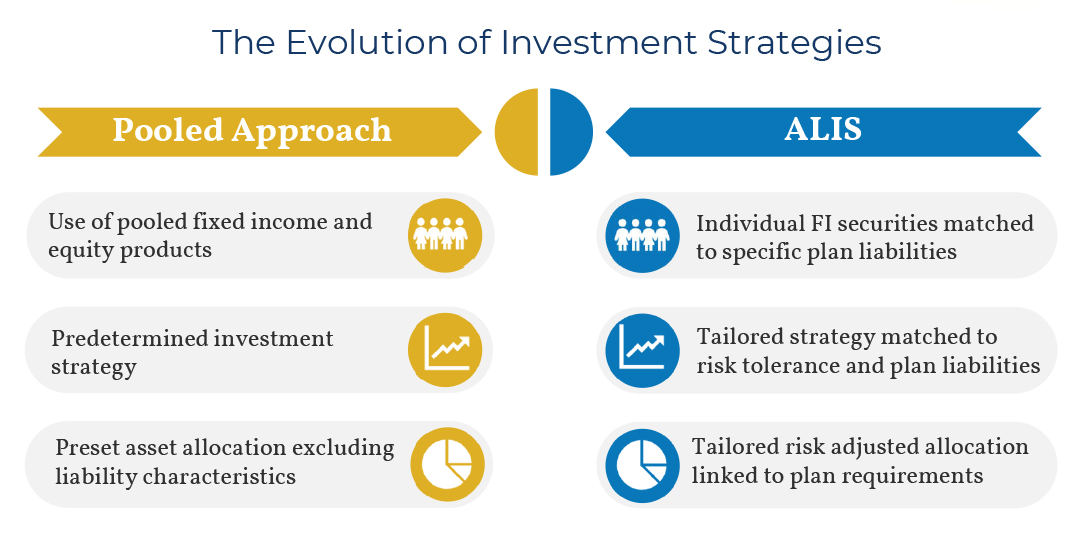

ALIS is a significant departure from the traditional maximum return generation approach to pension plan management.

Historically, the primary goal of most plan sponsors has been to maximize the return of their assets given a targeted risk level. While investment decisions were made to achieve the plan’s expected rate of return, there is little attention paid to the relationship between the plan’s assets and liabilities. The result lends itself to large swings in a plan’s funded status, required contributions, and balance sheet instability.

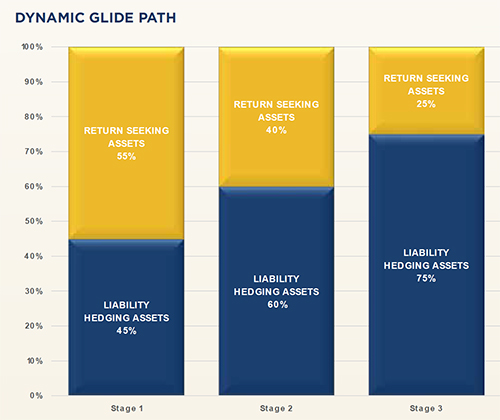

By incorporating a dynamic glidepath approach, plan sponsors can control the impact of swings in investment returns, changes in liabilities due to interest rate movements and the impact of inflation on the plan over the long term.

Advantages of an ALIS plan

- Advanced Capital Group’s Asset Liability Immunization Strategy (ALIS) is a dynamic method for pension plan sponsors to stabilize their funding ratio and future contributions relative to traditional pension plan strategies.

- We de-risk a pension plan by creating a custom glidepath where a precise set of targeted asset allocations are determined and adjusted as the plan’s funding ratio improves.

- Recognizing that all plans are different, our glidepath development begins with an understanding of the sponsor’s long-term funding goals. From there, a dynamic glidepath based on the ability to accept risk and return is determined.

Matching assets with liability over time

Common strategies often rely on a pooled fixed-income product to construct the liability immunization strategy. Although an improvement over a total return strategy, pooled vehicles create the possibility of a duration mismatch in key duration segments due to the fund configuration. To counter that risk, ACG’s fixed-income asset management team will work to develop a custom allocation which optimizes the match between your plan’s liability and asset durations. This customization enhances the effectiveness of the plan’s overall hedge ratio and immunizes the portfolio against any interest rate shocks due to duration mismatches. All asset management services are included in ACG’s stated advisory fee thereby potentially eliminating a portion of your plan’s management fees.

Learn How to Immunize Your Institution's Assets

Get a copy of our free guide.