Asset Liability Immunization Strategy (ALIS) Insights 4th Quarter 2023 Outlook

Executive Summary:

- Of particular concern is the risk of a confidence crisis, potentially triggered by continued economic pressures and policy challenges including the sustainability of government spending and the impact of higher borrowing costs.

- The strength of the job market is a key support for the economy, but there are risks if it falters. Inflation remains a central challenge, with the Fed's policies crucial in shaping the path forward.

- The U.S. government's fiscal health is a growing concern, with high deficits and debt levels. This has implications for future spending, taxation, and the broader economy.

State of the Markets

The economy and capital markets in the third quarter of 2023 navigated through turbulent waters, marked by persistent inflation, a strong yet potentially cooling job market, and significant shifts in fiscal and monetary policies. Inflation continues to be a thorn in the side of consumers and policymakers alike, with noticeable price increases in essential sectors such as energy, food, and housing. The Federal Reserve has maintained a steadfast approach in its battle against inflation, adopting a "Higher for Longer" mantra, signaling potential further rate hikes, and maintaining tight monetary policies. This has led to a deceleration in some growth metrics, while also contributing to higher bond yields and losses for fixed-income investors.

Domestic capital markets are pricing in these economic challenges and the potential for further accompanying policy responses, with bond yields experiencing notable increases, resulting in negative returns across various indexes over the quarter. The 10-Year Treasury yields, for instance, saw a significant rise from 3.84% to 4.57% over the quarter. This has led to a challenging environment for investors, particularly in the fixed-income space. The job market, while still robust, is showing early signs of cooling, and any significant reversal could have far-reaching implications for consumer confidence and spending, potentially exacerbating the existing economic challenges. The political landscape, stymied by dysfunction and short-term resolutions to pressing long-term issues such as the debt ceiling, adds another layer of uncertainty to the future economic outlook.

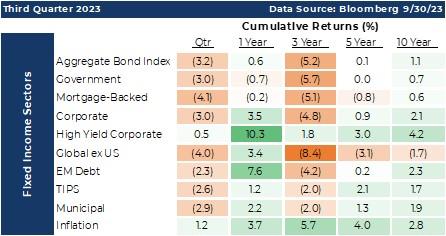

Cumulative returns for various fixed-income sectors over the third quarter of 2023 revealed mixed performance across broad sectors, reflecting the complexities and challenges faced by the fixed-income markets during this period. The Aggregate Bond Index experienced a decline of 3.2% in the quarter, highlighting the immediate pressures on the bond market of rising interest rates. However, on a one-year basis, it managed a slight gain of 0.6%. The Mortgage-Backed sector showed vulnerability, with negative returns extending to the five-year horizon. Investment grade corporates faced a quarterly decline of -3.0%, but provided positive performance over the one-year and longer horizons. The High Yield Corporate sector stood out with a strong 0.5% return in the third quarter and impressive gains of 10.3% over one year, showcasing investors’ reward for accepting credit risk in challenging market conditions. TIPS produced a -2.6% return in the third quarter as market participants priced potential future actions by the Fed.

Significantly rising interest rates created a challenging environment for fixed-income sectors. High Yield Corporates and Inflation demonstrated the only areas of positive return, while sectors like Global ex US and Mortgage-Backed faced more significant challenges. The mixed performance across sectors and the differing time horizons underscores the complexity of the fixed-income markets.

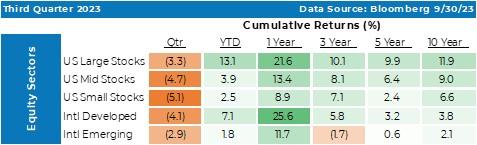

U.S. Large Stocks experienced negative performance in the third quarter with a return of -3.3%. Year-to-date, domestic Large Stocks have yielded a strong 13.1% return. Domestic Mid-Cap Stocks faced a more significant quarterly decline of -4.7%, with a modest year-to-date return of 3.9%. Over longer periods, the sector has shown resilience, particularly over a one-year horizon with a 13.4% return. U.S. Small-Cap Stocks encountered the steepest quarterly drop of domestic equities at -5.1%, reflecting their higher volatility. Their long-term performance also trails behind their larger company counterparts, with a one-year return of 8.9%. International Developed Stocks faced a -4.1% return in the third quarter, yet they have outperformed their U.S. counterparts over a one-year period with a 25.6% return. However, their growth tends to taper off over longer time frames.

In summary, the third quarter of 2023 has been challenging for many sectors, with declines across most broad asset classes. U.S. Large Stocks have proven to be a stronghold of consistent growth, particularly over longer time frames. Mid and Small U.S. Stocks, while facing steeper declines in the short term, have shown potential for growth but with higher volatility. Overall, the capital markets present a diverse landscape, with varying degrees of risk and potential for return.

Pension Market Update

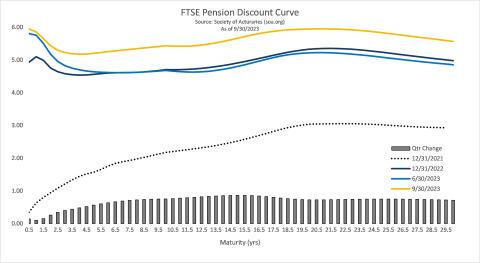

Strongly rising interest rates over the quarter were also reflected in the discount curves that are used to calculate the present value of pension liabilities and resulted in strongly decreasing present values. Combined with the negative performance of many capital market sectors, this led to the average plan experiencing an increase in its funded level over the period, as the denominator effect overpowered the numerator effects. The net impact when measured relative to asset returns, was a slight increase in the third quarter of pension funding levels to 103.6% as measured by the Milliman 100 Pension Funding Index, an increase of 1.1% over the prior quarter end. On a year-to-date basis, the average plan in the index experienced asset growth of 0.65%, offset by liability declines of 2.48% which resulted in an increase in funded status of 1.7% on the year.

Cash balance plans, dependent on their use of pooled investment vehicles, took a step backwards in their efforts of overcoming the negative performance experienced in 2022. Plans that utilize individual short bonds continue to perform well as their purchased yields have been increasing, allowing for reinvestment of cashflows into higher rates, with mostly positive outcomes relative to their interest crediting rates.

The enclosed graph provides evidence of how steeply pension discount rates moved upward over the quarter, after their brief pause in movement over the first half of the year. Including calendar year 2022, discount rates are up in some maturities nearly 6%. In periods of fluctuating asset performance, as we’ve experienced since the beginning of 2022, including the uncertainty in interest rates, adopting a liability-driven approach like our Asset Liability Immunization Strategy (ALIS) is crucial. This strategy ensures a balance of risks between the assets and liabilities in a pension plan, providing financial stability for both the plan sponsors and the participants.

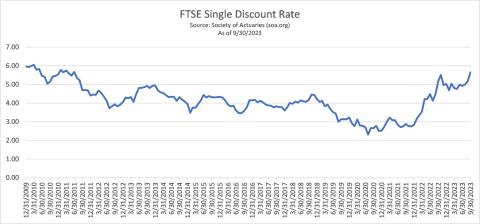

The FTSE Single Discount Rate is another data point that can be used to understand rate movements over the recent past. At a single point in time, the level is measured as the average rate across the entire maturity curve. We have to look back to June of 2011 to find a point where the rate was higher than today. What does this mean for the average pension plan? Independent of asset movements, it implies that through the discounting mechanism, pension liabilities are at their lowest value in over a dozen years. Plan sponsors should be thinking of de-risking and taking at least the initial step of implementing an LDI strategy such as ALIS to capture and maintain their newly improved funding levels prior to any pivot in interest rates which may accompany an economic slowdown. Often, the second and third steps in the de-risking order of operations is a lump sum offering and finally termination. All these steps have been strongly implemented by our clients over recent quarters. At a minimum, we suggest that now is the time to implement a highly customized liability-driven investment strategy which can alleviate financial risks.

Economic Outlook

The economy in the third quarter of 2023 was characterized by a complex interplay of inflationary pressures, a resilient job market, and the repercussions of fiscal and monetary policies. Inflation remains a significant challenge, with stubbornly high prices in critical areas such as energy, food, and housing, directly impacting consumer budgets and sentiment. The Federal Reserve has been actively working to curb inflation, maintaining a stance of keeping interest rates "Higher for Longer" and signaling the possibility of further rate hikes. Despite these efforts, some areas of inflation have proven resistant to change, continuing to exert pressure on consumers and the overall economy.

The job market has been a bright spot, providing a pillar of support for consumer spending and economic activity. However, there are emerging signs of potential cooling in certain sectors, and any significant shift in employment could have a cascading effect on consumer confidence and economic stability. The sustained strength in the job market has been crucial in balancing the impacts of inflation and helping to support consumers.

On the fiscal front, the U.S. is grappling with high levels of household debt, with significant portions tied up in auto loans and credit card debt. The pandemic era savings have been largely depleted, and real household incomes have been on a declining trend. Their financial strain is further compounded by the rising costs of essential goods and services, leaving consumers in a precarious position.

The political landscape adds another layer of complexity to the economic scenario. Dysfunctional politics and short-term resolutions, such as the temporary deferral of the debt ceiling crisis, highlight the challenges in achieving long-term fiscal stability and policy coherence. The downgrade of U.S. creditworthiness by major credit rating agencies underscores these challenges and reflects broader concerns about the country's fiscal health and political stability.

"...many historically relevant indicators are suggesting tough economic times are imminent."

Much of what was said last quarter continues to be our strategy for this quarter. Risk spreads remain tight, and we expect the Fed is effectively at the end of the tightening cycle. It suggests that if you are not compensated for taking on credit risk, a person should own high quality and safe names. Treasuries seem to be a smart place to be as we near 2024. Prior to the tensions in the Middle East, we would have estimated that 10-year Treasury yields had a good chance at exceeding 5% by late November or early December. The slowdown we anticipate in 2024 could still produce double-digit returns on 10-year Treasuries if yields fall back to the levels seen as recently as May. As mentioned last quarter, owning long duration bonds has historically been a good strategy when the Fed is near the end of a tightening cycle. The impact higher rates have on the economy and the low probability of three consecutive bad years for bonds makes us think that this episode won’t be any different. Mean reversion tends to matter in the arena of investment strategy. Whether it is the decline in leading indicators, the shrinking money supply, or the record number of days of inversion of the 3-month Treasury as compared to the 10-year Treasury, so many historically relevant indicators are suggesting tough economic times are imminent. Markets seem charged to deliver volatile times with geopolitical tensions meeting the exhaustion of the suspension of disbelief that, in fact, the jack-in -the-box we all know is eventually coming in the form of a recession will finally show its ugly face. For bond investors, the heart pounding surprise could lead to a relieving 2024.

In summary, the U.S. economy in the third quarter of 2023 navigated through a period of inflationary challenges, a strong yet potentially vulnerable job market, and fiscal uncertainties. The Federal Reserve's policy decisions and the resilience of the job market will play critical roles in shaping the economic trajectory in the coming months, while the political and fiscal landscape will require careful maneuvering to ensure long-term stability and prosperity.

Investment advisory services are offered through Advanced Capital Group (“ACG”), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed