Asset Liability Immunization Strategy (ALIS) Insights 4th Quarter 2024 Outlook

Executive Summary:

- The third quarter of 2024 demonstrated a rebound of markets with a shift towards value and smaller stocks, driven by economic uncertainties and supported by the Federal Reserve’s policy change.

- The Federal Reserve cut interest rates by 0.50% this quarter to address rising unemployment and inflation, aiming to stimulate economic activity and support the labor market.

- Declining job market confidence, high household costs, and credit expenses are expected to slow consumer activity, leading to more inflationary pressures and higher long-term bond yields.

State of the Markets

The third quarter of 2024 saw notable shifts in the domestic capital markets, characterized by a year-to-date continuation in stock market performance which was accompanied by a significant Federal Reserve policy change. After a challenging start to the month of August, the markets recovered, with a marked shift in leadership from big tech and growth stocks to value names and smaller stocks. This transition was driven by investors tolerance for stability amid economic uncertainties caused by their adjustment to the new market dynamics.

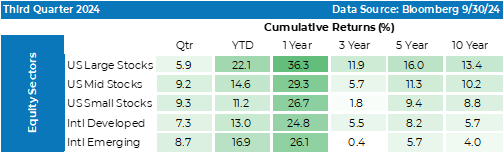

Large-cap stocks, as measured by the S&P 500, posted a solid return of 5.9%, while mid-cap stocks, represented by the Russell Midcap Index, returned 9.2%. Small-cap stocks, tracked by the Russell 2000 Index, outperformed with a 9.3% return. These returns evidenced a broad-based recovery, with smaller companies gaining traction as investors diversified their portfolios. International developed and emerging market equities also contributed positively, with returns of 7.3% and 8.7% respectfully.

A significant development during this quarter was the Federal Reserve’s decision to cut interest rates by 0.50%, marking the first rate cut of this cycle. The move was prompted by rising unemployment, which reached a 33-month high in July, and inflation returning to targeted levels. The rate cut aimed to stimulate economic activity and support the labor market, providing a boost to both equity and bond markets.

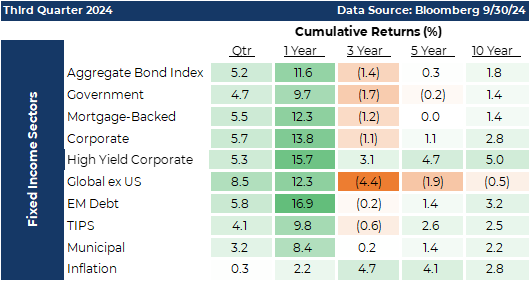

The Fed’s policy change at the September meeting led to a decline in yields across various fixed income sectors, with the 10-year Treasury yield falling to 3.5% by the end of the quarter. The rate cut provided a boost to bond prices, particularly benefiting shorter-duration instruments and high-quality credit. Investment-grade corporate bonds saw moderate gains, supported by strong credit fundamentals and attractive yields relative to historical norms which caused a repricing of credit risk as seen in the decline of credit spreads. High yield bonds also performed well, though with increased dispersion as investors became more selective amid economic uncertainties. Sectors such as non-agency residential mortgage-backed securities (RMBS) and senior collateralized loan obligations (CLOs) were favored for their high carry and shorter duration. In general, the fixed income market demonstrated resilience, with investors navigating through a complex landscape of policy shifts and economic indicators.

Overall, the third quarter of 2024 highlighted a period of adjustment and resilience in the domestic capital markets. Investors navigated through economic challenges by shifting their focus to value and smaller stocks, while the Federal Reserve’s policy actions provided additional support. As we move into the fourth quarter, market participants will likely continue to closely monitor further Fed actions, election turbulence and the resulting regulatory developments, in addition to ongoing geo-political risks which are becoming more significant.

Pension Market Update

Pension plans experienced several significant developments during the quarter. One of the primary changes was a decrease in the funded levels of most plans, especially with those that were less than 100% funded. This decline was mainly caused by lower discount rates, which increased the liabilities of these plans. Despite positive returns in most return-seeking asset classes, the overall funded status decreased in the quarter by approximately -0.8%, although the offset was that on a year-to-date basis the average plan maintained positive improvement in its funding level by +4.8%. The reduction in Treasury yields, which fell across the curve, played a crucial role in the quarterly trend, as it increased the present value of future pension liabilities to a larger extent, emphasizing the denominator effect in the ratio. The average pension index at quarter end now maintains a +4.5% surplus.

Another pension development occurred during the first half of the year where record sales of single premium buy-out contracts occurred with 327 being sold, amounting to $23.4 billion, as reported by Life Insurance Marketing and Research Association (LIMRA), in connection with Pension Risk Transfer (PRT) transactions. This represents a 16% increase year over year. Connected to this elevated annuitization volume was an increase in lawsuits surrounding pension risk transfer deals. For example, in July, three former employees of General Electric Co. sued the sponsor and its fiduciaries for alleged violation of their fiduciary duties of the firm’s previous 2020 PRT transaction. Additionally, retirees from Lumen Technologies and Bristol-Myers Squibb Co. filed separate lawsuits against their plan sponsors and fiduciaries in September regarding previous transactions. Overall, a total of six lawsuits have been filed in 2024 related to alleged breaches of fiduciary responsibility in connection with PRT transactions.

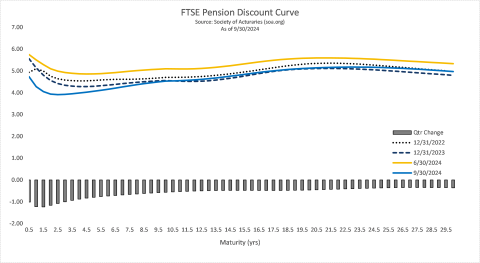

The FTSE Discount Pension yield curve finally corrected its inverted shape and normalized to an upward slope, if only to a minor extent, in the third quarter. This is a posture the curve hasn’t formed since the end of 2022. The change was mostly precipitated by the Fed’s policy actions which caused the discount curve to realign in maturities which were less than 5 years to a greater extent that other areas of the curve, although the entire curve saw some degree of decline. On average any one specific point on the curve experienced a decline of 57 basis points (bps), which in turn caused liability values to increase. At the same time, risk assets represented by the MSCI ACWI index performed positively with an absolute return of 6.7%. The combined effect on pension tracking indices was on the order of -1.7 - +0.1% improvement in funding with the average effect being -0.8%. The year-to-date progress was on the order of +1.3 – 7.8% depending on which index was referenced. The average index represented a year-to-date improvement of 4.8%.

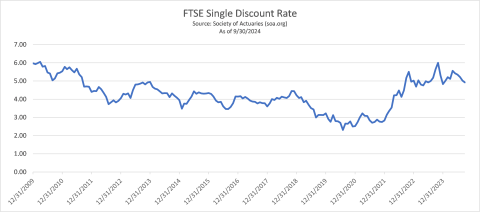

The single pension discount rate increased slightly since year-end, +9 basis points, while the third quarter led to a reversal of that trend. The quarter-to-date movement measured a decline of 43 basis points. Remember that falling discount rates translate into increasing present values resulting in declining pension funding levels.

Economic Outlook

In 2024, our fixed income investing theme was shaped by the expectation that persistent inflation would push yields higher in the first half of the year, as the market doubted the Federal Reserve’s ability to control inflation. The second half of the year was anticipated to see the effects of restrictive policies, such as higher borrowing costs, leading to an economic slowdown. However, housing prices and owners’ equivalent rent have not decreased as expected, despite higher borrowing costs, suggesting that factors like population growth and housing demand are providing price support. Despite higher interest rates, which have been significantly elevated compared to the past 20 years, consumer habits continue to evolve around the changing environment, although credit card balances reached near-record highs with average interest rates exceeding 20%. This situation highlights the complex interplay between market dynamics and consumer behavior in a high-price environment where buyers can operate beyond the boundaries of rational behavior for longer periods of time than would normally be perceived.

The Fed Funds Rate is a critical focus for the market, influencing both stocks and bonds. According to the Taylor Rule, the current rate is well-positioned, but this poses a challenge for the Federal Reserve. Market expectations, shaped by Chair Powell’s comments and the start of the easing cycle, anticipate further rate cuts in 2024 and 2025. However, recent economic data, including a robust job market and rising wages, complicate the Fed’s dual mandate of price stability and full employment. With unemployment at 4.1%, which is considered full employment, the Fed faces a dilemma in communicating and implementing upcoming policy moves. The long lag of policy effects adds to the complexity. While the Fed is not obligated to continue easing, human decision-making biases could influence future actions, potentially jeopardizing the goal of controlling inflation. The situation echoes of past policy challenges, raising questions about the Fed’s ability to navigate current economic conditions effectively.

Although economic metrics suggest a stable and healing economy, many people are struggling. This situation, described as a “Goldilocks” economy, shows no clear signs of weakness but the data is beginning to reflect the true financial difficulties faced by many. Consumer sentiment dropped sharply in September, with the Conference Board’s measure falling by 6.9 points to 98.7, the largest decline in three years. The percentage of consumers finding jobs plentiful fell for the seventh consecutive month, while those finding jobs hard to get increased. Household debt rose significantly in the second quarter of 2024, with credit card and auto loan balances reaching new highs. Delinquency rates for auto loans and credit card debt also increased, supporting the premise of additional financial stress. Concerns about the labor market and broader economy led to decreased confidence in current conditions and future expectations which adds to market volatility.

"The current economy could quickly deteriorate in the face of escalating global conflicts if future administrations mishandle foreign affairs."

The upcoming election is expected to pose a smaller risk to bond yields than previously anticipated, largely due to the likelihood of a divided government. The outcome may be one where some of the 2017 tax cuts expire in 2025 and election year spending promises may not materialize, leading to modest policy changes and a more controlled increase in the federal debt, which now exceeds $35 trillion. Trade policy and the risk of trade wars are emerging as significant risks to growth, with tariffs acting as both a short-term revenue source and a potential long-term destabilizer if used aggressively against trade partners and when combined with geopolitical tensions they add another layer of complexity. The intelligence community estimates a high probability of Russia using tactical nuclear weapons against Ukraine, a scenario unthinkable since the 1980s. Intelligent trade practices are seen as crucial for maintaining global peace and stability. The current economy could quickly deteriorate in the face of escalating global conflicts if future administrations mishandle foreign affairs. No matter how the election turns out, we take comfort in knowing that the end of the world, as you know it, won’t amount to the end of the world.

Domestically, the key question is whether the Fed can control inflation without causing economic pain, a rare achievement historically. Optimism and yields might improve once election uncertainty is resolved although a mild recession of one to two quarters is anticipated, with 10-year Treasuries possibly falling below 3% during the weakest part of 2025. Long-term borrowing costs are also expected to rise, especially if the U.S. loses its triple-A debt rating from Moody’s. The Federal Reserve’s significant initial move in the easing cycle may have been intended to allow policy to continue working while enabling Quantitative Tightening to reduce the Fed’s balance sheet for future crises. However, there is concern that individuals and institutions may have become accustomed to unsustainable deficit spending, and as stimulus effects wane, the economy should slow and then interest rates would naturally lower.

In the near term, inflation and the belief in the Fed’s support could push rates higher. Declining job market confidence, high household costs, and credit expenses are expected to slow consumer activity, leading to inflationary pressures and higher long-term bond yields. While an official recession might not occur in 2025, many will feel its effects in the approaching year.

Investment advisory services are offered through Advanced Capital Group (“ACG”), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed.